Investing for a better future

John E. Kaye

- Published

- Banking & Finance, Home, Sustainability

ESG Portfolio Management engages with the companies it is investing in to improve the sustainability and to support the transition towards a climate-neutral economy

We are guided by the United Nations Sustainable Development Goals (SDGs). In addition to our funds, our entire organisation focuses on sustainability. Our actions are always an expression of our values. Consistency in achieving the sustainability goals is central to this. Our investments focus on the goals “zero hunger” (#2), “good health and well-being” (#3), “quality education” (#4), “affordable and clean energy” (#7), “responsible consumption and production” (#12) and “climate action” (#13).

As we understand climate change as a serious risk and threat with high likelihood and impact, we support the adoption of the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). It is a key priority of ESG Portfolio Management to measure, understand and report climate related risk of all funds and portfolios. Currently, we publish the carbon intensity of the funds on a monthly basis in our standard report. We are working intensively to further reduce carbon emissions. On the one hand, we engage with companies to achieve this goal. On the other hand, we do not invest in companies with very high emissions or in companies that show no commitment to reduce emissions. We overweight technology leaders which have a competitive advantage in reducing carbon emissions and successfully perform adaption and mitigation.

ESG Portfolio Management performs climate scenario analysis to assess future climate-related risks and opportunities. The company recently calculated again that the holdings in both funds cause on average global warming of less than 1.75°C. We received the highest assessment of five leaves by Climetrics for both funds. Only 5% of 19.000 analysed funds receive this assessment.

We want to achieve the triple win:

- We believe that sustainable products and services have better market opportunities. This provides competitive advantages.

- The shares and bonds of these companies are expected to offer more opportunities with lower risks in the long term.

- Sustainable products and services, climate protection and waste reduction have a positive impact on many people worldwide.

ESG Portfolio Management has received several awards

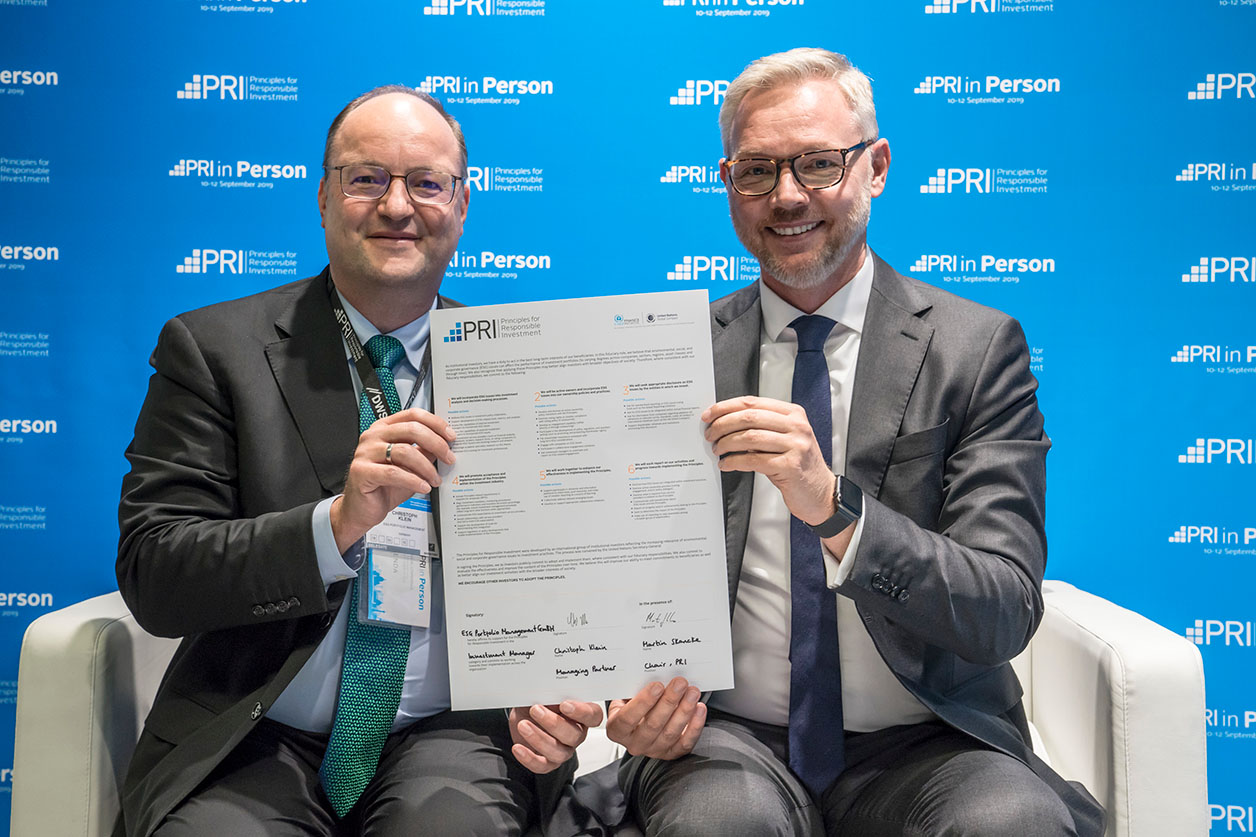

In 2020, the firm received the Sustainable Investment Award Multi-asset manager of the year and achieved the highest result in the TELOS ESG check. The organisation Principles for Responsible Investment (PRI) included ESG PM in its Leaders’ Group. In 2021 ESG PM won the ESG Investing Awards in the categories Multi Asset and Fixed Income. Both funds repeatedly received the FNG label with three stars (highest rating).

About the author:

Christoph M. Klein, CFA, is founder and manager at ESG Portfolio Management, an award- winning boutique for sustainable investments. He currently serves as a member of the CFA ESG Technical Committee and the DVFA Sustainable Investing Commission.

For further information:

esg-portfolio-management.com/en

This article is also featured in our Climate Change review, available to view here

RECENT ARTICLES

-

Strong ESG records help firms take R&D global, study finds

Strong ESG records help firms take R&D global, study finds -

How residence and citizenship programmes strengthen national resilience

How residence and citizenship programmes strengthen national resilience -

Global leaders enter 2026 facing a defining climate choice

Global leaders enter 2026 facing a defining climate choice -

EU sustainability rules drive digital compliance push in Uzbekistan ahead of export change

EU sustainability rules drive digital compliance push in Uzbekistan ahead of export change -

China’s BYD overtakes Tesla as world’s largest electric car seller

China’s BYD overtakes Tesla as world’s largest electric car seller -

UK education group signs agreement to operate UN training centre network hub

UK education group signs agreement to operate UN training centre network hub -

Mycelium breakthrough shows there’s mush-room to grow in greener manufacturing

Mycelium breakthrough shows there’s mush-room to grow in greener manufacturing -

Oxford to host new annual youth climate summit on UN World Environment Day

Oxford to host new annual youth climate summit on UN World Environment Day -

Exclusive: Global United Nations delegates meet in London as GEDU sets out new cross-network sustainability plan

Exclusive: Global United Nations delegates meet in London as GEDU sets out new cross-network sustainability plan -

Fast fashion brands ‘greenwash’ shoppers with guilt-easing claims, study warns

Fast fashion brands ‘greenwash’ shoppers with guilt-easing claims, study warns -

Private sector set to overtake government as main driver of corporate sustainability in 2026, report suggests

Private sector set to overtake government as main driver of corporate sustainability in 2026, report suggests -

Sir Trevor McDonald honoured at UWI London Benefit Dinner celebrating Caribbean achievement

Sir Trevor McDonald honoured at UWI London Benefit Dinner celebrating Caribbean achievement -

Historic motorsport confronts its energy future

Historic motorsport confronts its energy future -

Protecting the world’s wild places: Dr Catherine Barnard on how local partnerships drive global conservation

Protecting the world’s wild places: Dr Catherine Barnard on how local partnerships drive global conservation -

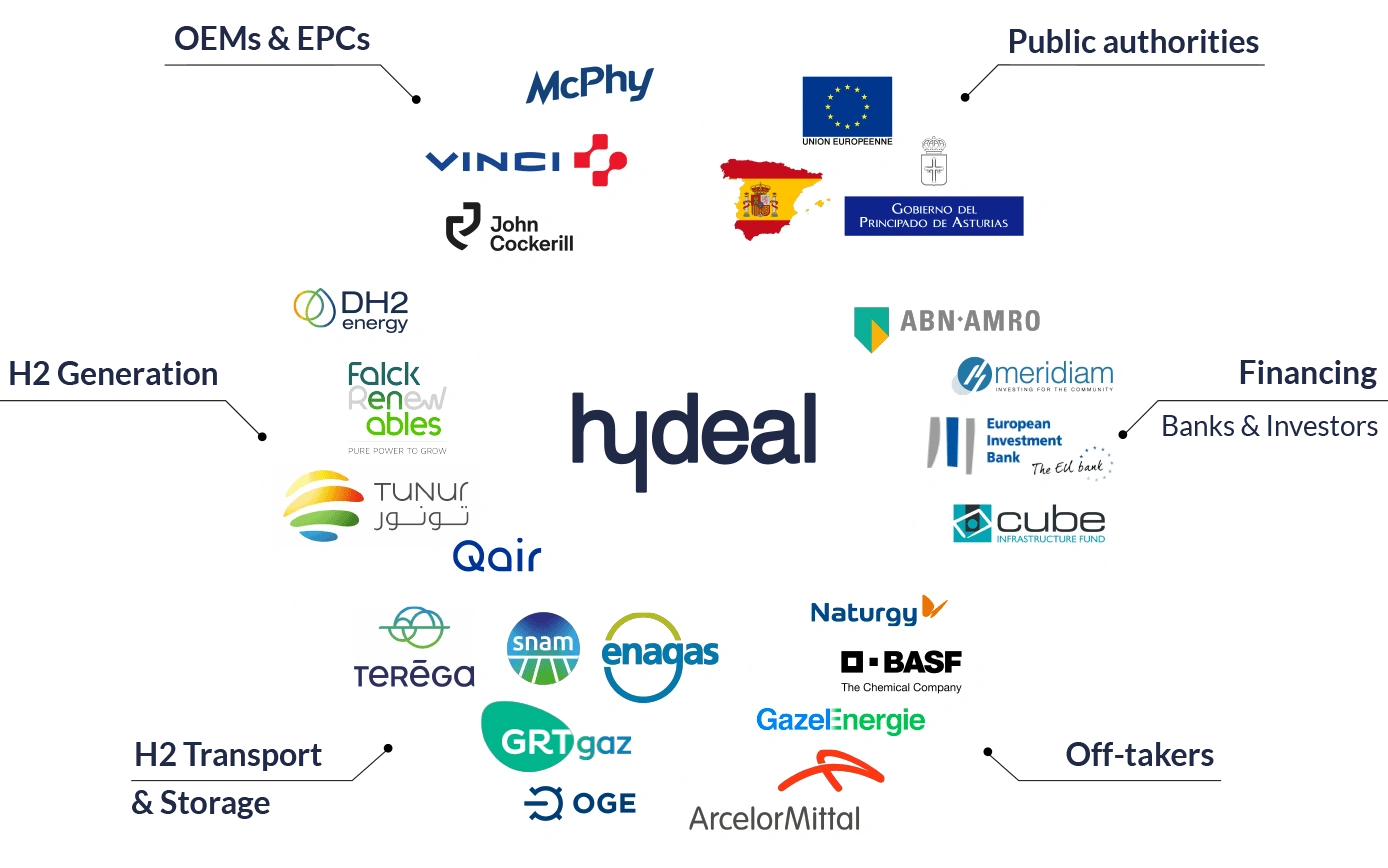

Europe’s HyDeal eyes Africa for low-cost hydrogen link to Europe

Europe’s HyDeal eyes Africa for low-cost hydrogen link to Europe -

Fabric of change

Fabric of change -

Courage in an uncertain world: how fashion builds resilience now

Courage in an uncertain world: how fashion builds resilience now -

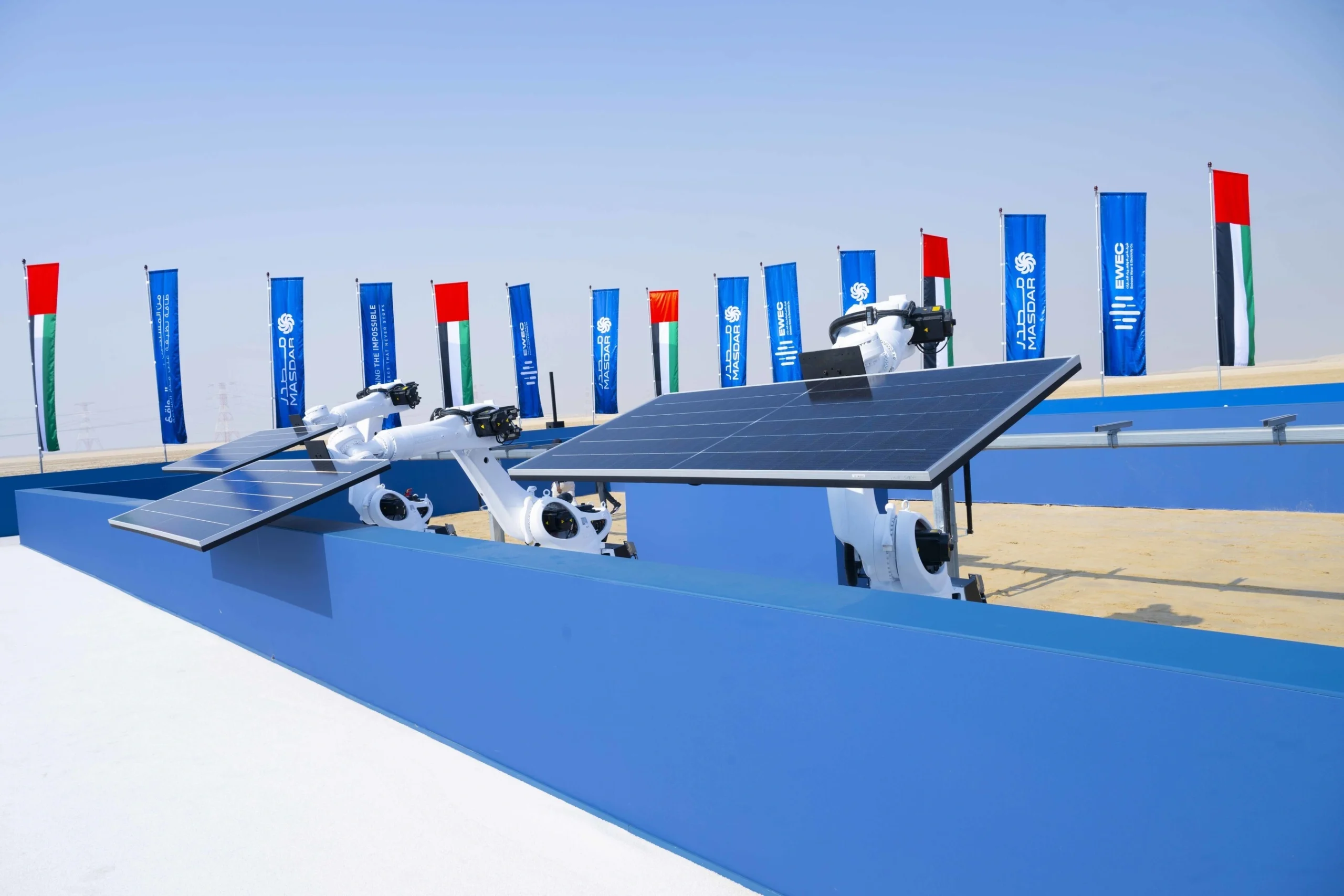

UAE breaks ground on world’s first 24-hour renewable power plant

UAE breaks ground on world’s first 24-hour renewable power plant -

China’s Yancheng sets a global benchmark for conservation and climate action

China’s Yancheng sets a global benchmark for conservation and climate action -

Inside Iceland’s green biotechnology revolution

Inside Iceland’s green biotechnology revolution -

Global development banks agree new priorities on finance, water security and private capital ahead of COP30

Global development banks agree new priorities on finance, water security and private capital ahead of COP30 -

UK organisations show rising net zero ambition despite financial pressures, new survey finds

UK organisations show rising net zero ambition despite financial pressures, new survey finds -

Gulf ESG efforts fail to link profit with sustainability, study shows

Gulf ESG efforts fail to link profit with sustainability, study shows -

Redress and UN network call for fashion industry to meet sustainability goals

Redress and UN network call for fashion industry to meet sustainability goals -

World Coastal Forum leaders warn of accelerating global ecosystem collapse

World Coastal Forum leaders warn of accelerating global ecosystem collapse